8 Real Estate Investment Tips for Beginners in Japan (2025)

Master Japanese property with our real estate investment tips for beginners. Learn about akiyas, financing, due diligence, and risk management to start today.

Posted by

Investing in real estate can feel like a monumental task, especially for a beginner. The Japanese market, with its unique characteristics like the prevalence of akiyas (vacant homes) and distinct regulations, adds another layer of complexity. However, it also presents a world of opportunity, from modern urban apartments to charming countryside homes ripe for revitalization. This guide provides actionable real estate investment tips for beginners specifically tailored to navigating the Japanese property landscape. We will move beyond generic advice to offer a practical roadmap.

Our focus is on equipping you with the foundational knowledge needed for success. We will cover a vetted collection of strategies, including:

- Market Research: How to pinpoint promising locations.

- Financing Options: Understanding your funding avenues.

- Due Diligence: Calculating costs and building a professional team.

- Risk Management: Starting small and maintaining essential cash reserves.

Whether you're an overseas buyer seeking a foothold in Japan, a digital nomad planning a future home, or a local first-time investor, these strategies will help you make informed decisions. Tools like mapdomo, which specializes in Japanese residential properties, can be invaluable in this journey, helping you visualize locations and filter through over 100,000 listings, including thousands of affordable akiyas. Let's begin building your investment strategy.

1. Understand the 'Location, Location, Location' Mantra in Japan

The timeless real estate adage "location, location, location" carries exceptional weight in Japan. While it's a universal principle, Japan's unique demographic landscape, featuring both hyper-concentrated urban growth and significant rural depopulation, makes a property's location the single most critical factor for its long-term viability. A well-placed apartment in Fukuoka has a drastically different investment profile than a house in a quiet, shrinking town.

This is one of the most fundamental real estate investment tips for beginners because overlooking it can lead to acquiring an asset with diminishing value and rental demand. A great location in Japan isn't just about being in a major city; it's about the micro-factors driving sustainable demand.

Why Location is Paramount in Japan

Success hinges on identifying areas with positive growth indicators. This means going beyond a city's name and digging into specific neighborhood data.

- Population Trends: Is the local municipality growing or shrinking? Japan's overall population is declining, but cities like Fukuoka, Sapporo, and central Tokyo wards continue to see population inflows.

- Economic Drivers: What supports the local economy? Look for neighborhoods near stable employers like university campuses, hospitals, or corporate headquarters. Areas undergoing urban revitalization with new commercial developments also offer strong potential.

- Transit Access: Proximity to a train station, particularly a major hub or Shinkansen (bullet train) station, is a massive advantage. Walkability to public transport is a key tenant priority.

Actionable Steps for Location Analysis

- Use Digital Tools: Platforms like mapdomo are designed for this detailed research. Their interactive maps allow you to overlay data on population trends, infrastructure, and amenities to visually assess a neighborhood's strengths. To get started, you can learn more about how to find a home in Japan on their blog.

- On-the-Ground Visits: If possible, visit potential neighborhoods at different times. A quiet residential street during a weekday can be very different on a weekend evening.

- Check Local Government Plans: Review municipal websites for city planning documents. These can reveal future development projects, new transit lines, or zoning changes that could impact property values.

- Analyze Market Data: Look at comparable sales and rental figures for the specific district (chome). This data reveals historical trends and current market rates, helping you make an informed offer.

2. The 1% Rule for Cash Flow Analysis

The 1% Rule is a rapid screening tool that helps investors quickly gauge the cash flow potential of a rental property. Popularized by real estate investing communities like BiggerPockets, the rule states that a property's gross monthly rent should be at least 1% of its total acquisition cost, which includes the purchase price plus any immediate repair costs. For example, a property acquired for ¥20,000,000 should ideally generate at least ¥200,000 in monthly rent.

This is one of the most critical real estate investment tips for beginners because it provides a simple, mathematical benchmark to filter out underperforming deals early. It prevents you from wasting time on detailed analysis of properties that are unlikely to generate positive cash flow from the start.

Why The 1% Rule is a Useful Filter

In a market as diverse as Japan's, this rule helps you maintain discipline. It forces you to focus on the numbers rather than getting swayed by a property's aesthetic appeal or a seemingly low purchase price.

- Quick Assessment: It allows you to sift through dozens of listings efficiently. If a property doesn't come close to the 1% mark, you can move on without extensive due diligence.

- Focus on Cash Flow: It grounds your investment strategy in profitability. While appreciation is a bonus, consistent cash flow is what sustains your investment through market fluctuations.

- Market Context: Applying this rule reveals market differences. You'll quickly discover that properties in high-demand urban centers like Tokyo may fall short (e.g., 0.5-0.7%), while those in regional cities or certain akiya (vacant house) scenarios might meet or exceed it.

Actionable Steps for Applying the 1% Rule

- Calculate Total Acquisition Cost: Sum the property's purchase price and the estimated cost of all necessary initial repairs and closing fees. This is your "all-in" number.

- Determine Gross Monthly Rent: Find the realistic market rent for the property. Check comparable rental listings on platforms like SUUMO or Homes.co.jp. Don't rely on optimistic seller estimates.

- Do the Math: Divide the gross monthly rent by the total acquisition cost. If the result is 0.01 (1%) or higher, the property warrants a deeper look.

- Follow Up with Detailed Analysis: The 1% Rule is a starting point, not a final decision. If a property passes, you must then conduct a full analysis, subtracting all expenses (taxes, insurance, maintenance, management fees, vacancy) from the income to find your true net operating income and cash flow.

3. Location, Location, Location - Research Neighborhoods Thoroughly

The fundamental principle "location, location, location" is the cornerstone of successful real estate investing. While other aspects of a property like its condition or interior can be changed, its location is permanent. This makes thorough neighborhood research the most critical due diligence step for any investor, especially when navigating a foreign market like Japan. A property's value is intrinsically tied to its surroundings, not just the building itself.

This is one of the most vital real estate investment tips for beginners because a desirable location provides a built-in safety net, driving consistent tenant demand and supporting long-term appreciation. A fantastic house in a declining area is a poor investment, whereas a modest apartment in a thriving neighborhood with strong economic fundamentals offers significant potential.

Why Neighborhood Research is Non-Negotiable

Success means identifying areas poised for stable growth. It requires a forward-looking analysis of demographic shifts, economic drivers, and planned infrastructure projects that will shape the neighborhood's future.

- Economic Stability: Look for areas with diverse and stable employers, such as university towns, neighborhoods anchored by major hospitals, or districts attracting new corporate offices. These create a consistent pool of potential tenants.

- Future Development: A neighborhood's trajectory is often revealed in municipal plans. New train lines, urban revitalization projects, or commercial zone expansions can dramatically increase property values and rental demand over time.

- Demographic Trends: Analyze population data. Is the area attracting young professionals and families, or is it experiencing an exodus? Areas with positive net migration are far safer bets for long-term investment.

Actionable Steps for Neighborhood Analysis

- Analyze Macro and Micro Data: Use specialized tools to overlay data on population trends, school ratings, and local amenities. This bird's-eye view helps you quickly compare different wards or cities. You can learn more about how to find a cheap home in Japan by researching these factors effectively.

- Conduct On-the-Ground Visits: Spend time in your target neighborhoods at various times, including weekdays, evenings, and weekends. This gives you a true feel for the community's rhythm, noise levels, and walkability.

- Review City Planning Documents: Check the official website for the local municipality (shiyakusho or kuyakusho). Look for urban planning documents that outline future projects, which can signal growth potential.

- Talk to Local Experts: Engage with local real estate agents who specialize in the area. They possess invaluable on-the-ground knowledge about market trends and neighborhood nuances that data alone cannot provide.

4. Build a Strong Professional Team

Navigating Japan's real estate market, with its unique legal and cultural nuances, is not a solo endeavor. Assembling a reliable team of professionals is one of the most critical real estate investment tips for beginners, transforming a daunting process into a manageable one. This team acts as your expert council, providing specialized knowledge that minimizes risk, ensures compliance, and ultimately enhances your investment's performance.

For an overseas investor, this local network is indispensable. A strong team bridges the gap in language, legal understanding, and market dynamics, allowing you to make informed decisions with confidence from anywhere in the world. Their expertise is the foundation upon which a successful and scalable property portfolio is built.

Why a Professional Team is Essential in Japan

Success in Japanese real estate hinges on local expertise. Each professional brings a crucial piece of the puzzle, from finding the right property to managing it effectively and optimizing its financial returns.

- Real Estate Agent (不動産業者 - Fudousan Gyousha): Your agent is your primary guide. A good agent specializing in investment properties will not only find listings but also provide initial analysis on potential returns and neighborhood viability.

- Judicial Scrivener (司法書士 - Shihou Shoshi): This legal professional is essential for handling property registration and title transfer. They ensure all legal paperwork is filed correctly, securing your ownership rights.

- Property Manager (管理会社 - Kanri Gaisha): For most investors, especially those living abroad, a property manager is non-negotiable. They handle tenant screening, rent collection, maintenance, and communication, ensuring your asset is well-maintained and profitable.

- Tax Accountant (税理士 - Zeirishi): A tax accountant with real estate experience can provide invaluable advice on navigating Japan's property and income tax laws, helping you maximize your net returns.

Actionable Steps for Assembling Your Team

- Seek Specialized Experience: Look for professionals who specifically work with foreign investors. They will be better equipped to handle the unique challenges, such as international fund transfers and bilingual communication.

- Interview Multiple Candidates: Don't settle for the first person you find. Speak with at least two or three professionals for each role to compare their experience, communication style, and fee structures.

- Request and Check References: Ask for references from other investor clients, particularly those with a similar profile to yours. A proven track record is the best indicator of future performance.

- Establish Clear Communication: Before committing, agree on communication frequency and methods. Whether it's weekly emails or monthly video calls, clear protocols prevent misunderstandings and keep you informed.

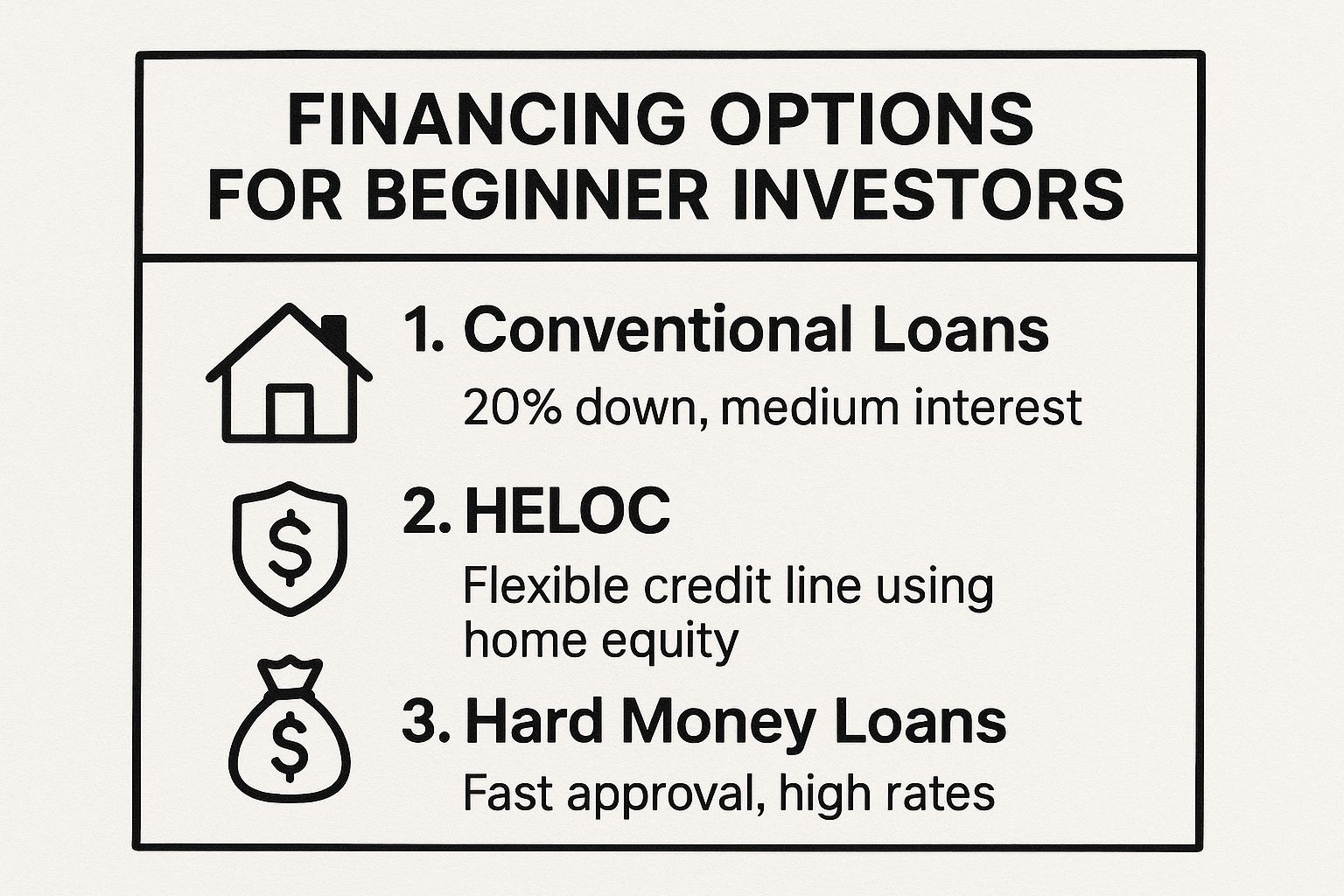

5. Understand Your Financing Options

Securing financing for an investment property in Japan is a different process than obtaining a mortgage for a primary residence. Lenders view investment loans as higher risk, which translates to stricter requirements, different loan products, and often less favorable terms. Understanding these distinctions is crucial for structuring a profitable deal and managing your capital effectively.

This is one of the most critical real estate investment tips for beginners because the right financing strategy directly impacts your cash flow, return on investment, and ability to scale your portfolio. Choosing the wrong loan can erode profits and limit future growth opportunities.

Why Financing Strategy is Crucial in Japan

Your financing choice determines your leverage and monthly holding costs. A well-structured loan can maximize your returns, while a poorly chosen one can turn a promising property into a financial drain. Success involves matching the loan product to your specific investment strategy, whether it's long-term rental income or a short-term fix-and-flip.

- Impact on Cash Flow: The interest rate and loan term dictate your monthly payment. A lower payment means higher monthly cash flow, a key metric for buy-and-hold investors.

- Leverage and Equity: Financing allows you to control a valuable asset with a smaller initial cash outlay. This leverage magnifies your potential returns as the property appreciates.

- Lender Requirements: Japanese banks have specific criteria for non-residents and for investment properties. Having permanent residency, a Japanese spouse, or a significant down payment can greatly improve your options.

Actionable Steps for Securing Financing

- Strengthen Your Financial Profile: Maintain a high credit score and a low debt-to-income ratio. Lenders need to see you as a reliable borrower. Keep immaculate financial records ready for submission.

- Compare Lenders: Don't accept the first offer. Shop around with multiple lenders, including major domestic banks (like SMBC Prestia), regional banks, and credit unions. Each may have different programs and risk appetites.

- Understand Loan Products: Research the differences between standard investment loans, which may require a 20-30% down payment, and other options like using a Home Equity Line of Credit (HELOC) on an existing property to fund a down payment.

- Prepare a Solid Business Case: For an investment property, lenders want to see a clear plan. Present them with projected rental income, expenses, and cash flow analysis to demonstrate the property's viability. You should prepare detailed answers to all the questions you might get before buying a home in Japan.

6. Start Small and Scale Gradually

The ambition to build a vast property portfolio can be exciting, but diving into large, complex deals from the start is a common and costly mistake. A much more prudent strategy is to begin with a smaller, manageable investment. This approach allows you to gain invaluable hands-on experience, learn the intricacies of the Japanese market, and build operational confidence with minimal financial risk.

This is one of the most crucial real estate investment tips for beginners because it creates a solid educational foundation. Making a mistake on a small single-family rental is a learning opportunity; making the same mistake on a large multi-unit apartment building can be a financial disaster. Starting small allows you to develop and refine your systems for tenant screening, maintenance, and financial tracking before scaling up.

Why Starting Small is a Winning Strategy

Success in real estate is often a marathon, not a sprint. A gradual approach ensures you have the skills and capital to stay in the race long-term.

- Risk Mitigation: A smaller property means a smaller mortgage, lower holding costs, and less potential financial loss if you face extended vacancies or unexpected repairs. This limited downside is essential for a first-time investor.

- Learning Curve: Your first property is your real-world classroom. You'll learn about everything from negotiating with contractors to navigating local property management norms in a low-stakes environment.

- Building a Track Record: Successfully managing a smaller property builds a history of positive cash flow and responsible ownership, making it easier to secure financing for larger deals in the future.

Actionable Steps for a Gradual Start

- Define Your "Small" Start: Your first investment should feel manageable, not overwhelming. This could be a single-room "one-room mansion" apartment in a city, a small single-family home (ikkodate) in a suburban area, or even a duplex where you can test management on a single tenant.

- Focus on Familiar Territory: Consider buying in a neighborhood you already know well. Your local knowledge of amenities, tenant demand, and typical rental rates provides a significant advantage.

- Master One Before Moving to Two: Resist the urge to immediately acquire a second property. Wait until your first investment is stabilized, cash-flowing positively, and running smoothly. This proves your system works.

- Document Everything: Meticulously track all income and expenses from day one. This practice helps you understand your true return on investment and is a critical habit for managing a larger portfolio later.

7. Calculate All Costs and Maintain Cash Reserves

One of the most common pitfalls for new investors is underestimating the true cost of owning a rental property. The purchase price is just the beginning; a successful investment depends on accurately forecasting all associated expenses and maintaining a financial safety net. A comprehensive budget prevents cash flow crises and ensures your investment remains profitable through inevitable ups and downs.

This is one of the most critical real estate investment tips for beginners because it shifts your focus from the exciting acquisition to the realities of long-term ownership. Failing to account for ongoing costs and emergencies can quickly turn a promising asset into a financial burden, forcing a premature and often unprofitable sale.

Why Comprehensive Budgeting is Non-Negotiable

Profitability is not just about rent minus mortgage. It's about rent minus all operational costs. In Japan, this includes annual fixed asset taxes (kotei shisan zei), city planning taxes, building management fees (kanrihi), and repair fund contributions (shuzen tsumitatekin) for condominiums.

- Avoid Negative Cash Flow: A detailed budget helps you see the real profit margin. Without it, unexpected repairs or a vacant month could easily erase your gains.

- Prepare for Capital Expenditures: Major systems like an HVAC unit, water heater, or roof have a finite lifespan. Systematically setting aside funds for these "CapEx" items prevents financial shock when they eventually need replacement.

- Maintain Financial Stability: Adequate cash reserves act as a crucial buffer. They allow you to cover expenses during tenant turnover or handle a large, unexpected repair without resorting to high-interest debt or liquidating other assets.

Actionable Steps for Financial Planning

- Use the 50% Rule as a Guideline: Start by estimating that 50% of your gross rental income will go toward expenses other than the mortgage payment. This includes taxes, insurance, vacancy, repairs, and management fees. Adjust this percentage based on the property's age and condition.

- Build Your Cash Reserves: Aim to hold at least six months of total expenses (including mortgage, taxes, and insurance) in a separate liquid savings account for each property. This provides a robust safety net.

- Create a Detailed Expense Spreadsheet: Track every yen. Itemize fixed costs (taxes, insurance) and create budget categories for variable costs like maintenance, repairs, and vacancy. Review and refine your budget against actual spending quarterly.

- Account for Vacancy: Research the average vacancy rate for your specific area in Japan and budget for it. A conservative estimate is typically 5-10% of the annual rent, meaning you budget as if the unit will be empty for about one month per year.

8. Educate Yourself Continuously

The Japanese real estate market is not static; it evolves with economic shifts, regulatory updates, and changing tenant preferences. A strategy that worked five years ago may not be optimal today. Committing to continuous education is what separates savvy, long-term investors from those who make a single, uninformed purchase. It's about building a deep knowledge base to navigate market cycles and identify emerging opportunities.

This habit is one of the most crucial real estate investment tips for beginners because knowledge directly mitigates risk. The more you learn about financing, tax laws, and market analysis, the more equipped you are to make profitable decisions and avoid common pitfalls that can derail a new investor's journey.

Why Continuous Learning is Non-Negotiable

Success in Japanese real estate requires adapting to a unique environment. Ongoing learning helps you understand the nuances of the market, from the shikikin (deposit) and reikin (key money) system to the specific legalities of property ownership for foreign nationals.

- Adapt to Market Changes: Japan's property market is influenced by factors like government incentives for renovation, shifts in tourism, and new infrastructure projects. Staying informed allows you to pivot your strategy accordingly.

- Discover New Niches: Through education, you might learn about untapped opportunities like investing in akiya (vacant homes), co-living spaces, or properties catering to specific demographics like students or single professionals.

- Refine Your Strategy: As you learn, you will refine your investment criteria. You might shift your focus from capital gains to cash flow, or from major cities to promising regional centers, based on new insights.

Actionable Steps for Ongoing Education

- Read Foundational and Localized Content: Start with classic real estate books to grasp universal principles. Supplement this by following Japan-specific real estate blogs and news sites that cover local market trends and legal changes.

- Listen to Industry Experts: Podcasts are an excellent way to absorb information during a commute. While global podcasts offer broad strategies, seek out interviews or episodes featuring experts on the Asian or Japanese property markets.

- Network with Purpose: Join online forums and social media groups dedicated to investing in Japan. These communities are invaluable for asking specific questions and learning from the experiences of others on the ground.

- Find a Mentor: Connect with an experienced investor who has successfully navigated the Japanese market. A good mentor can provide personalized advice and help you avoid costly beginner mistakes.

8 Key Real Estate Investment Tips Compared

| Strategy | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| Start with Your Primary Residence | Medium 🔄🔄 | Moderate (financing, maintenance) ⚡⚡ | Equity building, homeownership experience 📊📊 | First-time buyers, owner-occupants seeking appreciation | Easier financing, tax benefits, hands-on learning⭐⭐ |

| The 1% Rule for Cash Flow Analysis | Low 🔄 | Minimal (simple calculation) ⚡ | Quick investment screening, cash flow insight 📊 | Rental property screening, preliminary investment filter | Fast, consistent screening, easy comparison ⭐⭐ |

| Location, Location, Location | High 🔄🔄🔄 | High (research, data gathering) ⚡⚡⚡ | Long-term appreciation, tenant demand stability 📊📊 | Investors prioritizing market fundamentals and stable returns | Higher appreciation, lower vacancy, better resale ⭐⭐⭐ |

| Build a Strong Professional Team | Medium-High 🔄🔄🔄 | High (professional fees, relationship management) ⚡⚡ | Reduced risk, improved deal flow, expert guidance 📊 | Scaling portfolios, complex deals, risk mitigation | Access to expertise, time savings, liability protection ⭐⭐⭐ |

| Understand Your Financing Options | Medium 🔄🔄 | Moderate-High (credit, documentation) ⚡⚡ | Optimized capital use, faster portfolio growth 📊 | Investors needing leverage or varied financing strategies | Leverage, tax benefits, multiple loan options ⭐⭐ |

| Start Small and Scale Gradually | Low-Medium 🔄🔄 | Low-Moderate (smaller properties, simple management) ⚡ | Learning curve management, minimized risk 📊 | New investors, those cautious about risk and complexity | Lower risk, manageable learning, reinvest profits ⭐⭐ |

| Calculate All Costs and Maintain Cash Reserves | Medium 🔄🔄 | Moderate (detailed tracking, cash on hand) ⚡⚡ | Financial stability, stress reduction, better cash flow 📊 | Long-term investors, risk-averse, those valuing stability | Accurate budgeting, risk reduction, avoids forced sales ⭐⭐ |

| Educate Yourself Continuously | Variable 🔄 (depends on commitment) | Low to Moderate (time, cost for courses/books) ⚡⚡ | Improved decision-making, reduced mistakes 📊 | All investor levels, especially beginners and growth-focused | Better strategies, networking, confidence building ⭐⭐⭐ |

Your Journey to Japanese Real Estate Success Starts Now

Embarking on your real estate investment journey in Japan is an exciting venture, a path filled with unique opportunities that differ significantly from other global markets. From the potential of revitalizing a traditional akiya in a serene countryside town to securing a modern condo with steady rental returns in a bustling city, the avenues for growth are vast and varied. This guide has provided a foundational blueprint, a collection of essential real estate investment tips for beginners designed to demystify the process and empower your decisions.

The key to success, however, is not just absorbing this information but translating it into decisive action. Knowledge becomes power only when applied. By internalizing these core principles, you are no longer just an aspiring investor; you are a strategic planner preparing to navigate the Japanese property market with confidence and clarity.

Turning Knowledge into Actionable Steps

Let's distill the core takeaways from this article into a concrete action plan. Your immediate next steps should be focused and methodical, moving you from passive learning to active engagement.

- Revisit Your "Why": Before anything else, reaffirm your primary goal. Are you buying your first home as an investment ("house hacking"), seeking pure cash flow, or aiming for long-term appreciation? Your objective, as we discussed, dictates every subsequent decision.

- Build Your A-Team: Your most critical first move is to identify and connect with the right professionals. Start researching and contacting a bilingual real estate agent, a judicial scrivener (shiho shoshi), and a property manager. These relationships are the bedrock of a secure investment.

- Master the Numbers: Don't just browse listings. Practice running the numbers on potential properties. Apply the 1% Rule as a quick filter, then perform a deeper analysis by calculating your Gross Rent Multiplier (GRM) and, most importantly, estimating all potential costs from acquisition to ongoing maintenance and taxes.

- Begin Your Hyper-Local Research: Choose one or two prefectures or even specific neighborhoods that align with your goals. Use online resources and, if possible, plan a visit to understand the local demographics, infrastructure, and rental demand firsthand. True "location, location, location" expertise comes from this granular focus.

The Long-Term Vision: From First Property to Lasting Portfolio

Mastering these fundamentals is not merely about surviving your first purchase. It is about building a scalable and sustainable investment strategy that can serve you for years to come. Each tip, from starting small to maintaining cash reserves and committing to continuous education, is a building block for long-term wealth creation.

This disciplined approach transforms real estate from a speculative gamble into a predictable business. You learn to manage risks, identify genuine opportunities, and patiently grow your portfolio. The Japanese property market, with its unique characteristics and potential, rewards those who are diligent, educated, and strategic. Your journey starts with a single, well-researched step. The principles outlined here are your compass, guiding you toward a rewarding and profitable future in Japanese real estate.

Ready to put these real estate investment tips for beginners into practice? Start your property search with mapdomo, the visual platform designed to help you explore and analyze Japanese real estate with unparalleled clarity. Discover your ideal property and understand neighborhood data at a glance by visiting mapdomo today.