How to Verify Property Ownership a Complete Guide

Learn how to verify property ownership with our complete guide. Discover official methods, online tools, and expert tips to secure your real estate investment.

Posted by

Verifying property ownership is more than just a box-ticking exercise; it's the absolute bedrock of any secure real estate investment. Think of it as your first and most important line of defense against hidden liens, messy ownership disputes, and flat-out fraud. Trust me, skipping this step can lead to devastating financial losses and legal headaches you wouldn't wish on anyone.

Why You Can't Afford to Skip Property Verification

Before we jump into the "how," let's really get to grips with the "why." This isn't just about paperwork. It's about protecting yourself from costly assumptions in a market where what you don't know can and will hurt you.

Let’s say you’ve found a fantastic deal—maybe one of those intriguing abandoned houses for sale you hear about—and you're ready to move. Without doing your homework, you could end up buying a property with a massive unpaid tax bill attached, and suddenly, that's your debt. Or even worse, you could find out the person who "sold" it to you never had the legal right to do so in the first place.

The Real-World Risks of Cutting Corners

Failing to confirm who actually owns the property can blow up a deal in spectacular ways. These aren't just hypotheticals; I've seen them happen.

- Hidden Liens and Encumbrances: A property can have a lien against it, which is a legal claim for an unpaid debt. This could stem from anything—unpaid property taxes, an old mortgage, or even a contractor who did a renovation years ago and never got paid. If you buy that property, the lien can transfer to you.

- Ownership and Title Disputes: The ownership history isn't always clean. A property might have been passed down through generations without the proper legal filings. Suddenly, a previously unknown heir shows up with a legitimate claim to what you thought was your new home.

- Outright Fraudulent Transactions: In the worst-case scenario, you're dealing with a scammer. They use convincing forged documents to "sell" you a property they have no claim to, and then they vanish with your money.

Verifying ownership isn't just a best practice—it's the fundamental act of due diligence that separates a sound investment from a potential catastrophe. It’s the only way to confirm the seller has the legal authority to transfer the property to you, free and clear of any nasty surprises.

A Global Problem With Transparency

The need for this level of scrutiny isn't unique to one country; it's a global issue. Efforts are constantly underway to improve real estate transparency, and they highlight just how critical this step is in preventing illicit activities.

A recent study, the 2025 Opacity in Real Estate Ownership (OREO) Index, revealed that even major economies have significant gaps in property data and anti-money laundering regulations. In fact, a startling 10 of 24 key jurisdictions scored below 5 out of 10 on transparency. This just goes to show how challenging it can be to get a clear picture of ownership, no matter where you're buying.

Digging into Official Land Registry Records

When you absolutely need to know the truth about a property's ownership, you have to go to the source. That source is the official land registry office, often called the county recorder's office in some places. This is where the legal life story of a property is documented, making it your most powerful tool for verification.

Whether you're navigating a modern online portal or thumbing through files in a municipal building, this is the heart of your due diligence. These government bodies hold the official documents that define who owns what. So, let's talk about what you're actually looking for.

The Key Documents You'll Need

Your search really boils down to a few critical records. Each one tells a different part of the ownership story, and you need all the pieces to see the full picture.

- The Deed: This is the big one. The deed is the actual legal paper that transfers ownership from a seller to a buyer. Your main goal is to find the most recent deed and confirm the owner's name on it matches the person you're dealing with.

- The Title: People often use "deed" and "title" interchangeably, but they're different. A title isn't a physical document; it's the concept of legal ownership. A "clear title" is the goal—it means no one else has a valid claim or lien on the property.

- Liens and Encumbrances: A lien is a legal claim against the property, usually for an unpaid debt. It could be from a mortgage, unpaid property taxes, or even a contractor who did work and never got paid. Finding these is crucial because they have to be cleared before the property can be legally sold.

I always tell my clients to think of the land registry as the property's official biography. Every sale, every mortgage, every legal claim is a chapter in that book. Your job is to read it cover-to-cover so you don't get hit with a surprise plot twist after closing.

How to Actually Do the Search

First things first, you need to find the right office. Property records are typically managed at the county or municipal level. A quick search for "[County Name] recorder of deeds" or "[City Name] land registry office" will usually get you where you need to go.

Before you even start, arm yourself with as much information as you can. You'll need the full property address, of course. But the real golden ticket is the Assessor's Parcel Number (APN) or lot number. This unique identifier cuts through any confusion with similar-sounding street names.

Be prepared for the process to feel a bit analog. While some jurisdictions have fantastic online systems, many still require you to show up in person or mail in a formal request for records. Expect to pay a small fee for official copies.

This hands-on work is so important because the quality of record-keeping can differ dramatically from one place to another. This isn't just a local problem. According to experts at the World Bank, only about 30% of the world's population has a legally registered title to their land. That statistic really puts into perspective why verifying ownership can be so tricky and why you can't afford to skip this step. If you're interested in the global scope of this issue, the GIJN's research offers some fascinating insights.

At the end of the day, pulling these official records is non-negotiable. It’s the only way to be certain that the seller has the legal right to sell and that you won’t be inheriting a nasty financial surprise along with your new property.

Using Online Databases and Digital Tools

Before diving into official paperwork at a government office, your first move should almost always be a bit of online reconnaissance. Think of it as the preliminary investigation phase. Digital tools and property databases give you a massive head start, helping you gather quick intel and spot potential red flags before you invest serious time and money.

You’ll find a mix of options out there. Some are official government-run portals, which can feel a bit clunky but pull data straight from the source. Then there are the third-party platforms that aggregate information, often with a much friendlier interface. The key is to use them wisely and with a healthy dose of skepticism.

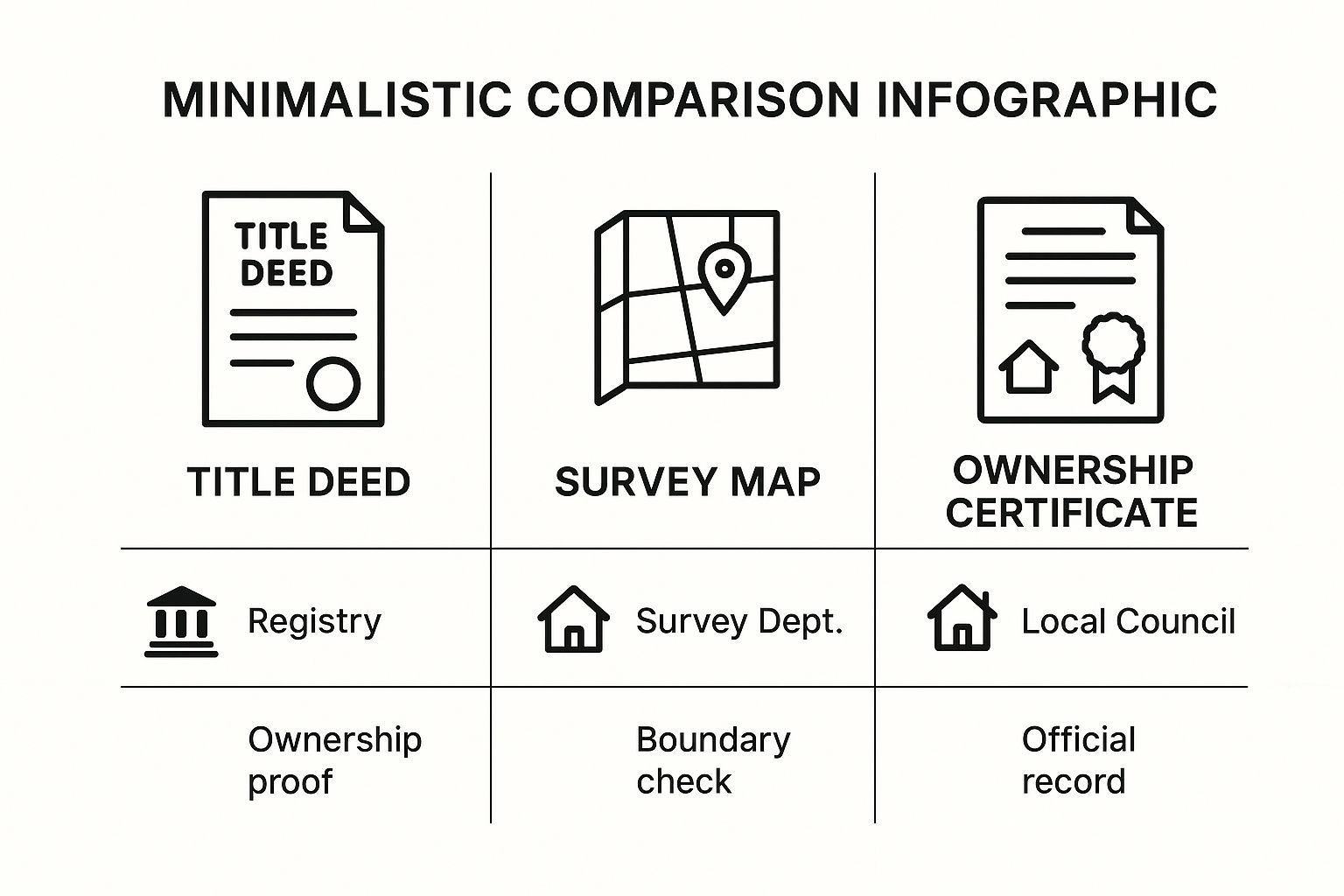

This visual gives a great overview of the essential documents you're ultimately looking for, whether you find them online or have to track them down in person.

As you can see, each document plays a specific role, from proving who legally owns the property to defining its exact boundaries.

How To Navigate Digital Property Records

When you start digging online, your main goal is to cross-reference everything. Does the owner's name on a real estate listing match what you find on a local government search? Are the property details—like the lot size or the year it was built—the same across different websites?

Any discrepancy is an immediate signal to slow down. For example, I once saw a property listed for sale, but a quick search on another database showed it had just been sold six months prior to a completely different person. That’s a massive red flag that tells you it's time to pull the official, legally binding records.

The real power of online tools isn't providing a final, legally-binding answer. It’s their ability to flag inconsistencies that demand a deeper, official investigation. Never, ever treat an online database as the absolute source of truth.

The usefulness of these tools can also vary dramatically depending on where you're looking. Some countries have incredible data transparency. For instance, the Global Open Data Index shows places like Taiwan have nearly 100% data coverage, making online checks a breeze. In other regions, however, the data is far less accessible, forcing you to rely almost entirely on manual, in-person record checks. You can see how different countries compare by looking at the complete land ownership data rankings.

Comparing Your Options

When you're deciding how to approach your verification, it helps to understand the trade-offs between a quick online search and getting the official government documents. Each method has its place.

Online vs Official Record Verification Methods

| Attribute | Online Databases (Third-Party) | Official Government Records (In-Person/Direct) |

|---|---|---|

| Speed & Accessibility | Fast and convenient, accessible from anywhere. | Slower, often requires a physical visit or formal request. |

| Accuracy & Reliability | Varies widely. Prone to outdated or incomplete data. | The definitive source of truth. Legally binding and current. |

| Cost | Often free or low-cost for basic information. | Typically involves a fee for certified copies. |

| Best Use Case | Initial research, cross-referencing, and spotting red flags. | Final due diligence, legal transactions, and dispute resolution. |

Ultimately, online tools are for building your initial case file, while official records are the evidence you take to "court." You need both to be truly thorough.

Spotting Inaccurate or Outdated Information

One of the biggest traps you can fall into with third-party databases is stale information. A property might look clean on a website, but the database hasn't been updated to show a recent lien placed on it for unpaid taxes. This happens more often than you'd think and can cause huge headaches later on.

Here’s a practical workflow I recommend for using these tools effectively:

- Start Broad: Use a major real estate portal to get a bird's-eye view. Look at the property's sales history, tax records, and general information.

- Go Local: Next, check if the local municipality or city office has its own online property search portal. This data is usually more current and reliable.

- Cross-Reference Everything: Compare the information from at least two or three different sources. Pay close attention to owner names, sale dates, and any mention of liens or other issues.

These early steps are invaluable, especially if you're evaluating an investment. For anyone looking at the Japanese market, understanding the financial landscape is critical. You can get a better sense of the market by reading up on current Japan housing prices. Just remember: online research is the vital first step that supports, but never replaces, official verification.

When You Need to Hire a Professional

While the online portals and registry offices are fantastic tools for a preliminary check, there are situations where a DIY approach just won’t cut it. Think of it as knowing the limits of your own expertise.

When you're dealing with confusing property histories, potential boundary disputes, or transactions that feel even slightly out of the ordinary, it's time to bring in a specialist. Trying to untangle these knots yourself can easily lead to overlooking a critical detail—a mistake that could put your entire investment at risk.

The Role of a Title Company

Think of a title company as your property detective. Their job is to perform a comprehensive title search, digging much deeper than the surface-level information you might find on your own. They painstakingly trace the ownership history of the property, creating what’s known as a "chain of title."

Their goal is to ensure this chain is unbroken and free of any hidden problems. They’re specifically looking for red flags like:

- Undisclosed Liens: Money owed to contractors or back taxes that could become your problem.

- Existing Mortgages: Old loans on the property that were never officially closed out.

- Easements or Encumbrances: The legal right for someone else (like a utility company or a neighbor) to use part of your land.

By uncovering these potential issues before you sign anything, a title company helps guarantee you receive a "clear title." This is your assurance that you are the one and only legal owner.

When to Call a Real Estate Attorney

A title company confirms the what, but a real estate attorney explains the what if. You need an attorney in your corner when the situation involves any legal gray areas or requires expert interpretation. Their job is to protect your legal interests.

It's smart to hire an attorney if you run into scenarios like these:

- Inherited Properties: These can be messy, often involving multiple heirs, unresolved family disputes, or outstanding estate issues.

- Commercial Transactions: These deals are a different beast entirely, with complex zoning laws, existing tenant leases, and specific business regulations to navigate.

- Unusual Deed Clauses: If the property deed contains vague or restrictive language, you need a legal expert to tell you exactly what you’re agreeing to.

An attorney doesn't just give advice; they can review, draft, and negotiate contracts to make sure the terms are fair and legally binding. For any high-stakes or non-standard property deal, they provide an indispensable layer of security.

Hiring a professional isn't an admission of defeat; it's a strategic move. Their expertise is your best defense against future disputes and financial loss, turning a complex process into a secure transaction.

Finally, don't forget the surveyor. You'll need one if there's any doubt about the property's physical boundaries. Is that neighbor's fence creeping over the line? Is the official property map unclear? A surveyor provides a definitive, legally recognized map of your land, heading off costly and stressful boundary disputes down the road.

Before you finalize anything, being prepared is your greatest asset. Getting familiar with a guide on what to ask before buying a home in Japan will arm you with the right knowledge and perfectly complements the work your professional team is doing.

Spotting and Dealing with Common Red Flags

Sometimes, the verification process turns up some problems. This isn't necessarily a dead end—think of it as a crucial moment for your due diligence. Honestly, spotting these issues early is your best defense against major headaches down the road. Knowing what to do next is what separates a smart buyer from one who’s about to make a costly mistake.

You have to put on your detective hat here. Your investigation might uncover a "broken chain of title," unexpected liens, or names on official documents that just don't match up. Each of these is a serious red flag, and your response needs to be methodical, not emotional.

Navigating Liens and Encumbrances

Discovering a lien on a property you're interested in is probably one of the most common hiccups you'll encounter. A lien is simply a legal claim against the property for an unpaid debt. It means a creditor has a financial stake in that property, whether it’s the government for unpaid taxes or a contractor who never got paid for a renovation.

If a lien pops up, your first job is to get the details. Who placed it, and for how much? In a standard transaction, the seller is responsible for clearing any and all liens before the sale can go through. This is usually handled by paying off the debt with the proceeds from the sale at closing.

My advice is simple: do not move forward with the purchase until you have proof that all liens have been officially released. A title company is your best friend here; their job is to resolve these claims to ensure the title you receive is clear of any financial baggage.

Mismatched Names and Clerical Errors

So, what do you do when the seller’s name doesn't perfectly match what's on the deed? First, don't panic. More often than not, this is due to a simple clerical error, a legal name change after a marriage or divorce, or complications arising from an estate.

It does, however, demand immediate clarification. You'll want to ask the seller for documentation that explains the difference, like a marriage certificate or official name change papers. If the situation is more complex, especially with inherited property, it could signal a "cloud on the title," which is just a fancy way of saying ownership is unclear.

- Minor typos: Often, a simple affidavit of identity or a correction deed can clear this up quickly.

- Major discrepancies: This is your cue to bring in a real estate attorney, period. They can dig into the ownership history and tell you if it's an easy fix or a sign of a much bigger issue, like a fraudulent seller.

A Broken Chain of Title

The chain of title is the property's ownership history, tracing it from the current owner all the way back to its origin. A "broken" chain means there's a gap in that history. Maybe a past sale wasn't recorded correctly, or a deed is completely missing.

This is a very serious problem. It throws into question whether the seller even has the legal right to sell the property to you. If the chain is broken, you can forget about getting title insurance from a title company, and no lender will approve a mortgage. Fixing this often involves legal action, like a "quiet title" lawsuit, to legally establish who the clear owner is. It’s a complex, often lengthy process that absolutely requires professional legal guidance.

Got Questions? We’ve Got Answers.

When you start digging into a property’s history, it’s completely normal for questions to pop up, especially if you find something unexpected. Getting things cleared up early on is the key to a smart investment, not a surprise headache. Let’s tackle some of the most common things people ask during this process.

How Long Does Property Verification Actually Take?

Honestly, it varies. You could get a preliminary hit in a few minutes, but it could also stretch out for weeks. It all comes down to how deep you need to go.

A quick search on an online database can give you a snapshot almost instantly, but treat that as a starting point, not the final word.

For something you can actually rely on, you'll be requesting official documents from the local Legal Affairs Bureau. That can take a few business days, sometimes longer if they're swamped. If you're going through a formal real estate transaction, a professional will conduct a comprehensive title search, which usually takes about one to two weeks to wrap up.

What causes the hold-up? A complicated history. Delays often happen when a property has:

- A long list of owners in a short amount of time.

- Lingering legal issues, like inheritance disputes.

- A messy "chain of title" where deeds or records are missing.

I Found a "Cloud on Title." What Now?

First off, don't panic, but don't ignore it either. A "cloud on title" is just industry-speak for any claim, lien, or oddity that makes ownership look fuzzy. It essentially casts a shadow over the seller's legal right to hand the property over to you, free and clear. It could be as simple as a typo on an old document or as serious as a surprise claim from a long-lost relative.

Discovering a cloud on the title is a serious red flag. The sale absolutely cannot move forward until it’s resolved.

When a title search reveals a cloud, your first call should be to a real estate attorney or a judicial scrivener. They’re the experts who can dig into the problem, gauge how serious it is, and map out the legal steps needed to "quiet the title" and make the ownership crystal clear.

I Already Verified Ownership. Do I Still Need Title Insurance?

Yes. One hundred percent. It’s a question that comes up all the time, but your personal check and title insurance are doing two totally different jobs.

When you do your own due diligence, you're combing through public records for known problems—issues that have been officially documented somewhere.

Title insurance, however, is your shield against the unknown. It protects your investment from nasty surprises that would never show up in a public records search. We’re talking about things you’d have no way of finding yourself:

- Forgery or fraud on documents from decades ago.

- Clerical errors made at the registry office.

- Previously unknown heirs who suddenly appear with a legitimate claim.

Here’s a good way to think about it: your verification work is like checking the weather forecast before you leave for a trip. Title insurance is the travel insurance that saves you when a freak storm hits. It’s a one-time fee at closing that protects your ownership rights for as long as you have the property.

Ready to find your perfect property in Japan without the guesswork? mapdomo provides an interactive platform to discover thousands of homes, from modern apartments to traditional akiyas, with clear, accessible information. Start your search and explore your future home at https://mapdomo.com.